Sophie Glaser-Deruelle

Senior Consultant

The Daily Rate Calculation Methodology in Horizon Europe.

Horizon Europe is a €100bn grant funding programme spanning 2021 to 2027 – our blog series provides you with 8 prerequisites you must understand to be successful.

In this, the 7th of our 8 blogs, we are focusing on project budget in Horizon Europe and specifically the Daily Rate Calculation Methodology. In short, Horizon Europe is switching from a Person Month Cost, used in Horizon2020 to a Daily Rate Cost.

Horizon Europe is a funding opportunity that every SME, Public Body, Research Institution and Citizen Group could benefit from. We at IFE understand that the new Horizon Europe funding programme can also be confusing – there are new requirements and areas of focus compared with Horizon 2020. Once you have read this short blog series you will understand what is new in Horizon Europe.

Main Points

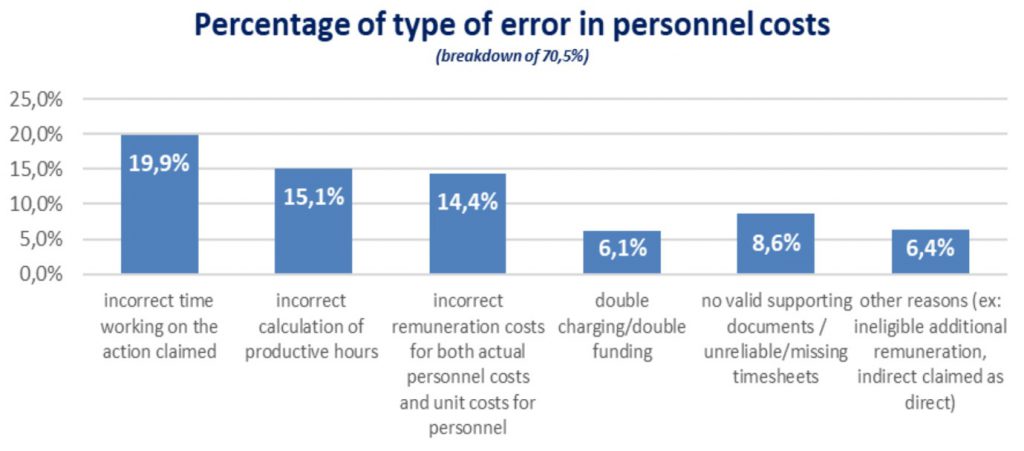

There were some errors made in the financial claims under Horizon2020, in particular in claiming for personnel costs – in fact personnel costs caused the most problems in financial claims.

In Horizon Europe this process is going to be simplified to reduce the errors and make life easier (more predictable) for project managers responsible for project budgets.

Under Horizon Europe, personnel costs will be calculated using a Daily Rate based on the following definitions:

- Daily Rate (€) = Annual Personnel Costs (€) for the Person / 215 (working days in a year)

- Days Worked = A Monthly Declaration (no time sheet needed)

On the basis of these definitions then, the Personnel Cost (€) = Daily Rate (€) x Days Worked.

That is the simple bit! There are a few things that need unpacking from here. Firstly, it is acceptable to work on an 8 hour day, or applicants can calculate productive hours (see the annex of this presentation).

Secondly, the “Personnel Cost” includes the following items:

- The wage of the person paid by the employer

- Social Security Contributions paid by the employer

- Further Variable Salary Components (as stated in an employment contract or required by national regulations)

- Taxes paid by the employer

Conclusion

Using Daily Rates will simplify budgeting and reporting under Horizon Europe in comparison with Horizon2020 – this is good news for participants when building budgets and drawing down funding. Details of Personnel Costs and eligibility will be given in detail in the Corporate Model Grant Agreement (cMGA) and we would advise checking with this document and guidance for further clarifications.